Explore web search results related to this domain and discover relevant information.

Discover the characteristics and economic role of middle market firms, with yearly revenues of $10M-$1B. Learn how they trade and their impact on job creation.

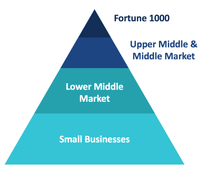

Middle market firms, with annual revenues between $10 million and $1 billion, are integral to the U.S. economy. Comprising about 200,000 firms, these privately held or closely owned companies contribute over $10 trillion in annual revenues and support approximately 48 million jobs.By regulation, a BDC must invest at least 70% of its assets in private or public U.S. firms with market values of less than $250 million. The companies they invest in are often young businesses in need of financing or companies that are struggling to emerge from financial difficulties.Investors may also be able to invest directly in the shares of business development companies that provide financing to middle-market firms. Because BDCs are regulated investment companies (RICs), they must distribute over 90% of their profits to shareholders.Main Street is an informal term for small businesses with a relatively small number of employees that take in a modest amount of revenue. Middle market firms are larger, with more staff and revenues in the tens to hundreds of millions annually.

:max_bytes(150000):strip_icc()/midsection-of-man-cutting-fish-1095159668-b2e201e3985144e5963587473d86b435.jpg)

Here’s what you need to know to get started with law firm marketing to successfully bring in new clients and build your firm's brand.

Law firm marketing is the practice of attracting new potential clients to your firm. A law firm marketing plan may cover a mix of digital marketing, SEO, blogging, print, and digital ads. It may also include other tactics, such as harnessing technology like Clio Grow to streamline your marketing efforts.Plus, you’ll discover eye-opening stats to inform your marketing choices, best practices and industry insights, and the top law firm marketing technology and tools to use. Discover how AI can boost your law firm’s marketing efforts in our guide: Maximize Your Marketing Impact With AI: A Strategic Guide for Law Firms.Marketing your legal services is integral to the growth and success of your law firm. Marketing is an effective way to build brand awareness, attract legal clients, and retain current ones. It’s important to understand the basics of law firm marketing before moving into planning and execution.With the right approach, you can easily develop and execute a marketing plan for a large or small law firm. You can use the following steps to help you achieve your goal, whether you want to create a sustainable solo practice or rapidly grow your firm. Here are 11 areas to consider when creating a marketing strategy for your law firm:

Founded in 1920, the NBER is a private, non-profit, non-partisan organization dedicated to conducting economic research and to disseminating research findings among academics, public policy makers, and business professionals.

We develop a quantitative theory of prices in firm-to-firm trade with bilateral negotiations and two-sided market power. Markups reflect oligopoly and oligopsony forces, with relative bargaining power as weight. Cost pass-through elasticities into import prices can be incomplete or complete, depending on the exporter's and importer's bargaining power and market shares.In U.S. import data, we find that U.S. importers have substantial market power and disproportionate leverage in price negotiations. The estimated model produces accurate predictions of the impact of Trump tariffs on pair-level prices.At the aggregate level, ignoring two-sided market power could exaggerate tariff pass-through by about 60%.

Schroders Plc and Phoenix Group Holdings Plc have agreed to establish a new investment management firm that will deploy billions of pounds in private assets on behalf of British pensioners.

Learn about perfectly competive labor markets and how to draw them. To help you study before your next AP, IB, or College Microeconomics Exam.

Below is a quick examination of the important aspects of perfectly competitive factor markets. If you haven’t already learned about MRP and MRC calculations, make sure you go review them first before moving on. Note: The examples below use labor but these concepts apply to a firm’s use of capital and land as well.When drawing a perfectly competitive factor market, there are generally two side by side graphs; one for the industry (the market) and one for the firm. The industry (or market) is a standard supply and demand curve. The equilibrium wage (price) in the market establishes the wage each firm will pay its workers.The demand curve in a perfectly competitive labor market is derived from the demand for the product the workers produce and the productivity of the individual workers. ... Marginal Resource Cost (MRC): Sometimes called Marginal Factor Cost (MFC) is the firm’s cost of hiring more workers.In a competitive labor market, the MRC will be the equilibrium wage. A firm will hire workers as long as the MRP is greater than the MRC. The profit maximizing number of workers to hire is where the MRC = MRP.

In economics, firms are organizations that produce goods and services. They are typically owned and operated by individuals or groups of individuals, and are motivated by the desire to make a profit. They play a crucial role in the functioning of market economies by:

Publicly traded company: A publicly traded company is a company whose shares are traded in a public stock market. The choice of a firm structure depends on the goals and objectives of the business and the legal and tax environment of the country where the firm operates.Emergence is the process of a new firm being established, either through the creation of a new business or the spin-off of a division from an existing company. Emergence can happen in different ways, for example through: Entrepreneurship: A new business is created by an entrepreneur who identifies a need in the market and starts a company to fulfill it.Emergence can have a positive impact on the economy, creating jobs and driving innovation. However, it can also be challenging for new firms to survive in a competitive market and establish themselves as sustainable long-term businesses.They can also include costs associated with complying with trade agreements, such as certifications and inspections. External transaction costs can add significant costs to conducting business and can make it more difficult for firms to operate in certain markets.

Market conditions are pushing many law firms away from moderate demand growth, giving way to big changes across demand certain growth tiers.

However, these overall trends hide important differences between law firm segments. Each group saw unique shifts, showing how similar conditions led to very different results depending on the firm’s size and market position.The Am Law Second Hundred responded differently to today’s market pressures. Instead of moving in a single direction like other law firm segments, firms in this group were pulled toward both strong growth and weaker results.While the Am Law Second Hundred showed a more balanced spread of results, Midsize firms moved sharply upward. Market conditions pushed many of these firms into top performance, with the number of high achievers more than doubling. At the same time, fewer firms struggled with serious challenges.Factors like international exposure, slower hiring, and changes in client needs seem to be pushing firms toward either strong results or weaker demand, with fewer staying in the middle. These conditions are making competition within this group more intense. In the second quarter of 2025, the legal market continued to evolve, with different types of firms reacting in their own ways to changing conditions.

Financial News: US trading giant Jane Street files case against SEBI in SAT after being barred for alleged market manipulation of Indian indexes.

Mid Market Latest Breaking News | Mid Session Commentary| Stock Market Live | Share Market | Stock Market Trading | Nifty Today With The Capital Market.

By Chris Sloan Sept. 10, 2025, © Leeham News: Embraer announced today that Embraer’s E2 will finally break into the U.S. market with a firm order from ULCC Avelo for 50 E2-E195s and 50 purchase rights, becoming E2’s... Read More

Sept. 10, 2025, © Leeham News: Embraer announced today that Embraer’s E2 will finally break into the U.S. market with a firm order from ULCC Avelo for 50 E2-E195s and 50 purchase rights, becoming E2’s 22nd customer.The Embraer E195-E2 can accommodate up to 146 passengers in a single-class, all-economy layout with 28-inch pitch, or 132 seats with 31-inch pitch. The larger gauge E195-E2 has emerged as the sweet spot of the market, with 330 total orders, 140 delivered, and 190 in firm backlog.Embraer E2 Finally Breaks Into The U.S. Market Following 50 Firm Orders +50 Purchase Rights from ULCC Avelo AirlinesSeptember 10, 2025In June 2025, SkyWest placed a firm order for 60 E175s with options for 50 more, further underscoring the type’s dominance in the U.S. regional market.

In the context of general equities, prices at which a security can actually be bought or sold in decent sizes, as compared to an inside market with very little depth.

Firm market · In the context of general equities, prices at which a security can actually be bought or sold in decent sizes, as compared to an inside market with very little depth. See: Actual market. Earnings per share (EPS) Beta · Market capitalization ·Outsmart the market with Smart Portfolio analytical tools powered by TipRanks.By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

A middle-market firm is one with a size that falls in the middle range of a market or industry. U.S. businesses can be divided into three categories

A middle-market firm is one with a size that falls in the middle range of a market or industry. U.S. businesses can be divided into three categories – the big, middle-market, and small businesses. The middle-market firms are larger than the small businesses and smaller than the big businesses.No unified standard exists to define middle-market firms. The size of a firm can be measured through various metrics, i.e., asset size, annual revenue, net income, or the number of employees. Compared with the Fortune 1000 companies, middle-market firms offer more growth potential.Investors can track the performance of mid-cap stocks through several indices, such as the S&P Mid-Cap 400 Index, the CRSP U.S. Mid-Cap Index, and the Russell Mid-Cap Index. The S&P Mid-Cap 400 is a float-weighted index that covers 400 U.S. middle-market firms.It defines the mid-cap stocks as the ones with their market capitalizations above $200 million and below $5 billion. Firms that fall below the $200-million threshold are classified as small-cap, and those with more than $5 billion are classified as large-cap. Investors can invest in middle-market firms by purchasing their shares directly or through ETFs.

The “Buy Now, Pay Later” (BNPL) lender Klarna reported that it sold 34.3 million shares at $40 each during its US IPO debut.

The “Buy Now, Pay Later” (BNPL) lender reported 34.3 million shares sale valued at $40 each, above its marketed $35-$37 range. Per a Reuters report, the sale equates Klarna to a $15 billion valuation. The firm’s valuation slumped to $6.7 billion in 2022, at a time when interest rates and inflation were soaring.Swedish payments firm Klarna raised $1.37 billion in its U.S. initial public offering (IPO), amid burgeoning US market debuts.The Sequoia Capital-backed firm’s IPO on Tuesday follows a wave of offerings from Circle, Figma and Bullish, which have revived the broader IPO market.Besides, fintech firm and stablecoin issuer Figure Technology revealed plans to go public this month.

In brief: The market and the firm are two forms of economic cooperation. How do they differ? When is the market the more efficient form of organization? When is the firm, as a form of cooperation, superior? The market...

The market and the firm are two forms of economic cooperation. How do they differ? When is the market the more efficient form of organization? When is the firm, as a form of cooperation, superior? The market functions where potentially concurrent exchange transactions in a homogenous resource with known characteristics are to be executed.In other words, the firm initiates and carries out investments. This is a preview of subscription content, log in via an institution to check access. ... Unable to display preview. Download preview PDF. Unable to display preview. Download preview PDF. ... (2009). Market or Firm?.

RXO’s SWOT analysis: freight firm navigates market challenges, stock outlook

RXO, Inc., a prominent player in the logistics and transportation services sector with annual revenue of $5.56 billion, has been navigating a complex market environment characterized by fluctuating freight conditions and integration challenges following a significant acquisition.The company has faced headwinds due to lackluster freight conditions, which have put pressure on earnings and revenue growth, as evidenced by its current WEAK Financial Health Score of 1.6 on InvestingPro. In response, RXO has been actively working on operational expense reductions to mitigate the impact of these market challenges, maintaining a moderate debt level with a debt-to-equity ratio of 0.43.RXO’s market position remains strong, despite the current challenges. The company is well-positioned to benefit from an eventual recovery in truckload fundamentals, which could provide a significant boost to its performance.One of RXO’s key strengths is its strong free cash flow conversion and clean balance sheet. These financial attributes provide the company with flexibility and resilience in the face of market fluctuations.

The India VIX closed at 10.84, up slightly by 0.56%, reflecting relatively stable volatility despite intraday swings. In the derivatives market, the highest Call open interest was at the 24900 strike, while the highest Put open interest was at the 24,500 level, indicating a firm resistance ...

The India VIX closed at 10.84, up slightly by 0.56%, reflecting relatively stable volatility despite intraday swings. In the derivatives market, the highest Call open interest was at the 24900 strike, while the highest Put open interest was at the 24,500 level, indicating a firm resistance near 24900 and solid support around 24,500.”Stock Market Today | Share Market Updates - Find here all the updates related to Sensex, Nifty, BSE, NSE, share prices and Indian stock markets for 9 September 2025.Gold prices on Tuesday surged ₹723 to touch an all-time high of ₹1,10,312 per 10 grams in the domestic futures market, tracking strong global cues amid growing expectations of a US Federal Reserve interest rate cut next week.Gold has reached new all-time highs above $3695 (~Rs 109,500) to start the week on a strong bullish note. The action builds on last week’s surge as investors become more confident that the Fed would lower interest rates at its September monetary policy meeting — a move that markets now regard as almost certain after a run of poor US job market data.

Delve into the findings of the new book Financing Firm Growth: The Role of Capital Markets in Low- and Middle-Income Countries, a joint IFC-World Bank research analyzing over 20,000 firms across 106 low- and middle-income countries.

Join and explore future World Bank Group collaboration on capital markets development. Delve into the findings of the new book Financing Firm Growth: The Role of Capital Markets in Low- and Middle-Income Countries.Read Financing Firm Growth: The Role of Capital Markets in Low- and Middle-Income Countries

A middle-market firm is one with a size that falls in the middle range of a market or industry. U.S. businesses can be divided into three categories – the big, middle-market, and small businesses. The middle-market firms are larger than the small businesses and smaller than the big businesses.

A middle-market firm is one with a size that falls in the middle range of a market or industry. U.S. businesses can be divided into three categories – the big, middle-market, and small businesses. The middle-market firms are larger than the small businesses and smaller than the big businesses.No unified standard exists to define middle-market firms. The size of a firm can be measured through various metrics, i.e., asset size, annual revenue, net income, or the number of employees. Compared with the Fortune 1000 companies, middle-market firms offer more growth potential.Investors can track the performance of mid-cap stocks through several indices, such as the S&P Mid-Cap 400 Index, the CRSP U.S. Mid-Cap Index, and the Russell Mid-Cap Index. The S&P Mid-Cap 400 is a float-weighted index that covers 400 U.S. middle-market firms.It defines the mid-cap stocks as the ones with their market capitalizations above $200 million and below $5 billion. Firms that fall below the $200-million threshold are classified as small-cap, and those with more than $5 billion are classified as large-cap. Investors can invest in middle-market firms by purchasing their shares directly or through ETFs.

In this Refresher Reading learn about perfect and monopolistic competition, oligopoly, monopoly and the relationship between price, MR, MC, demand elasticity for each of them. Determine a firm’s optimal output and long-term pricing strategy.

This learning module addresses several important concepts that extend the basic market model of demand and supply to the assessment of a firm’s breakeven and shutdown points of production. Demand concepts covered include own-price elasticity of demand, cross-price elasticity of demand, and income elasticity of demand.We analyze distinctions between the different structures that are important for understanding demand and supply relations, optimal price and output, and the factors affecting long-run profitability. We also provide guidelines for identifying market structure in practice. · Firms under conditions of perfect competition have no pricing power and, therefore, face a perfectly horizontal demand curve at the market price.Shutdown occurs when a firm is better off not operating than continuing to operate. If all fixed costs are sunk costs, then shutdown occurs when the market price falls below the minimum average variable cost.The minimum point on the long-run ATC curve defines the minimum efficient scale for the firm. Economic market structures can be grouped into four categories: perfect competition, monopolistic competition, oligopoly, and monopoly.

A Designated Primary Market Maker (DPM) is a specialized market maker approved by an exchange to guarantee a buy or sell position in a particular assigned security, option, or option index. Most foreign exchange trading firms are market makers, as are many banks.

The income of a market maker is the difference between the bid price, the price at which the firm is willing to buy a stock, and the ask price, the price at which the firm is willing to sell it. It is known as the market-maker spread, or bid–ask spread.In U.S. markets, the U.S. Securities and Exchange Commission defines a "market maker" as a firm that stands ready to buy and sell stock on a regular and continuous basis at a publicly quoted price.On the LSE, there are official market makers for many securities. Some of the LSE's member firms take on the obligation of always making a two-way price in each of the stocks in which they make markets.Market makers usually also provide liquidity to the firm's clients, for which they earn a commission.A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a tradable asset held in inventory, hoping to make a profit on the difference, which is called the bid–ask spread or turn. This stabilizes the market, reducing price variation ...

:max_bytes(150000):strip_icc()/midsection-of-man-cutting-fish-1095159668-b2e201e3985144e5963587473d86b435.jpg)